Introduction

In the fast-paced digital economy, payment processing has become a cornerstone for businesses striving to offer seamless transactions to their customers. Platform-Based Payment Gateways have emerged as a revolutionary solution, enabling businesses to integrate diverse payment methods into a single interface. This article explores the growth, benefits, challenges, and future trends of the platform-based payment gateway market.

Understanding Platform-Based Payment Gateways

A platform-based payment gateway serves as an intermediary between merchants and financial institutions, facilitating secure online transactions. Unlike traditional payment gateways that operate independently, platform-based gateways are designed to support multiple payment methods, currencies, and financial services under one umbrella. These gateways cater to e-commerce platforms, financial technology (FinTech) firms, subscription-based services, and other digital enterprises.

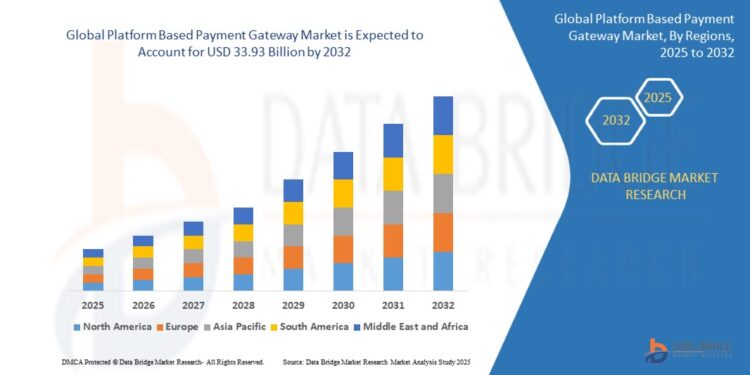

Market Growth and Key Drivers

The platform-based payment gateway market has witnessed significant expansion, driven by multiple factors:

- Rise of E-commerce and Digital Payments – The surge in online shopping and mobile commerce has fueled the demand for robust payment solutions that offer seamless checkout experiences.

- Adoption of FinTech Solutions – The increasing reliance on digital wallets, blockchain transactions, and peer-to-peer payments has amplified the need for versatile payment processing platforms.

- Globalization and Cross-Border Transactions – Businesses expanding internationally require gateways that support multiple currencies and localized payment methods.

- Security and Compliance – Enhanced encryption technologies and compliance with regulations like PCI DSS and GDPR have boosted trust in digital payments.

- Technological Advancements – Artificial intelligence, machine learning, and automation are enhancing fraud detection and improving transaction efficiency.

Benefits of Platform-Based Payment Gateways

Platform-based payment gateways offer numerous advantages to businesses and consumers alike:

1. Enhanced User Experience

By integrating multiple payment options, these gateways ensure a frictionless checkout process, leading to higher conversion rates and customer satisfaction.

2. Multi-Currency and Localization Support

Businesses can operate globally by accepting payments in different currencies and accommodating region-specific payment methods like UPI in India or WeChat Pay in China.

3. Advanced Security Measures

Encryption, tokenization, and biometric authentication help safeguard transactions, reducing risks associated with fraud and cyber threats.

4. Seamless Integration

Modern APIs and plug-and-play integrations allow businesses to easily incorporate payment processing into their existing platforms without extensive development efforts.

5. Real-Time Analytics and Reporting

These gateways provide comprehensive dashboards that help businesses track transactions, monitor fraud patterns, and make data-driven decisions.

Get More About : https://www.databridgemarketresearch.com/reports/global-platform-based-payment-gateway-market

Challenges in the Market

Despite the advantages, the platform-based payment gateway market faces several challenges:

1. Regulatory Compliance

Different countries have unique financial regulations, requiring payment gateways to adhere to various compliance standards, which can be complex and costly.

2. High Competition

With multiple players entering the market, businesses must continuously innovate to maintain a competitive edge.

3. Security Threats

As digital payments grow, so do cybersecurity risks. Companies must invest in robust security frameworks to protect sensitive financial data.

4. Transaction Fees and Costs

Processing fees and integration costs can be significant for small and medium enterprises (SMEs), impacting their profit margins.

Emerging Trends in the Platform-Based Payment Gateway Market

Several trends are shaping the future of platform-based payment gateways:

1. AI and Machine Learning for Fraud Detection

Advanced algorithms are being deployed to detect fraudulent transactions in real time, reducing chargebacks and financial losses.

2. Blockchain-Based Payments

Decentralized payment processing through blockchain technology is gaining traction for its transparency and security benefits.

3. Subscription-Based Payment Models

With the rise of streaming services, SaaS platforms, and membership-based businesses, subscription management tools integrated into payment gateways are in demand.

4. Contactless and Biometric Payments

Innovations like facial recognition, voice authentication, and fingerprint scanning are revolutionizing payment security and convenience.

5. Open Banking Integration

Regulations like PSD2 in Europe are encouraging open banking frameworks, allowing seamless connectivity between banks and payment service providers.

Conclusion

The platform-based payment gateway market is poised for continued growth as businesses and consumers demand faster, safer, and more flexible payment solutions. While challenges like regulatory compliance and cybersecurity persist, technological advancements and evolving consumer behaviors will drive the next wave of innovation. Companies that invest in scalable, secure, and user-friendly payment platforms will be well-positioned to thrive in the dynamic digital payments landscape.

Get Related Reports :

https://www.databridgemarketresearch.com/reports/global-insulated-shippers-market

https://www.databridgemarketresearch.com/reports/global-proteasome-inhibitors-market

https://www.databridgemarketresearch.com/reports/global-solar-shading-systems-market

https://www.databridgemarketresearch.com/reports/global-bells-palsy-treatment-market

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-marine-and-freshwater-seedsseedlings-market